OneFamily is an Associate Member of the Building Societies Association.

OneFamily is an Associate Member of the Building Societies Association.

Something that I’ve noticed more and more in recruitment and promotion interviews is that people want to be part of a team that they know they’ll thrive in.

The talented applicants that I’ve met often say that the diversity within our business makes us more attractive as an employer. Being able to see someone who is like you at all levels of the organisation means that you know you’ll have a voice; that you’ll be heard.

We’re very lucky at OneFamily that our diverse workforce is reflected from our Board and Executive Team to our most junior roles. It’s something we’re very proud of. We want those differing perspectives at all levels, because we are mirroring the society in which we are existing. So, diversity is also essential in helping us to understand our customers.

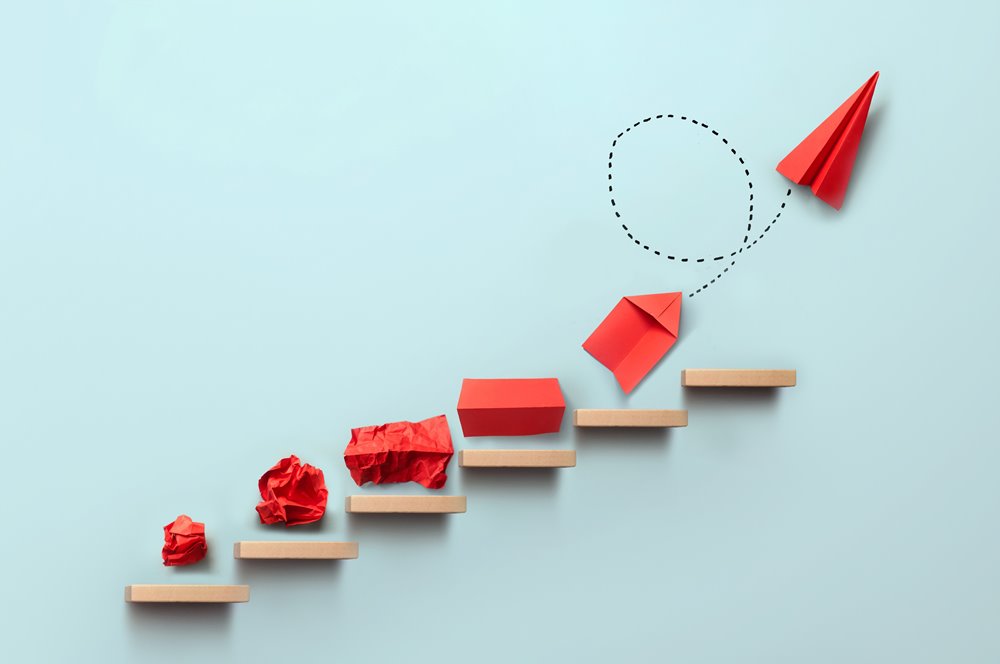

It’s important for those who are in the early stages of their career to be able to look at our most senior management and see someone that they relate to. We want them to be able to think, ‘That person is a bit like me,’ – and to aspire to move up the organisation.

As part of this, it’s vital that women are involved in all levels of our organisation. In terms of representation, if you look at our customers, a very large proportion of them will be women. It’s very often women who are making the financial decisions in their households.

As an inclusive employer we seek to have an environment that supports people whose circumstances might not enable them to work a traditional 9 to 5, five days a week. For example, those with caring responsibilities - whether that’s people looking after older relatives, parents or, increasingly, Grandparents who look after their Grandchildren. These are all people with skills and experience that we value and each bring something new to the conversation. So, we actively seek to accommodate people with other responsibilities or who need additional support to enable them to be able to do their job.

This makes good business sense too - having a diverse team positively influences the products and services that we develop, and how we talk about them. Because representation is as important to our customers as it is to our colleagues.

To find out more, visit OneFamily

f055.png)